IS IT THE RIGHT TIME TO REFINANCE?

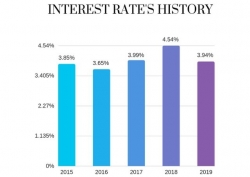

As interest rates for the average 30-year fixed-rate mortgage have gone down from 4.54% to 3.94% in May 2019, millions of homeowners can now benefit from refinancing their property to get a lower interest rate on their mortgage.

After a continued increase since 2016, this year the interest rates dipped below the 4% mark. There are currently almost 6 million loan receivers who could get an advantage of this interest's drop. This is the largest population of eligible candidates in 3 years. Home-buyers are running to refinance, especially the 2018 borrowers who are leading the line.

The answer to "is it a good idea to refinance?" cannot be a Y/N solution. There are plenty of individual variables to take into account before rushing into making any decision. The first question you should ask is if you will stay in your home long enough to cover the closing costs compared to the savings you are making on your monthly payment.

Some people could say it might be better to wait for an even lower interest rate, but the truth is that since it's a 10 year low, there are more chances that the rates go back up. According to the mortgage broker David Bolton, there hasn't been a better time to refinance after the crash 10 years ago. In a normal scenario, borrowers could break even from the 2% closing fees cost when refinancing in less than a year.

TAX LAW IS CHANGING THE FLORIDA REAL ESTATE GAME

Tax refugees keep coming to shiny Florida looking for a better lifestyle and tax benefits. With an almost unbeatable advantage of not having state nor city taxes, South Florida has become a paradise to New York, New Jersey, Illinois, and Connecticut residents.

High-income earners are the ones suffering the most after the law reinforcing a deduction for state and local property taxes of only $ 10,000.

The financial decision of moving their homestead to Florida has been taken by over a million New York taxpayers.

,

So I did my little home made research and out of the total sales after the Tax Law (2017), 52% of the buyers in South Beach, 54% in Brickell and 61% in Downtown are US nationals! These results seem impressive for Miami since usually up to 70% of the buyers are foreigners. Maybe soon English will be the primary language in Miami !

LESSONS LEARNED THIS MONTH

As I was planning my newsletter I thought, - why do I always show the glitter to my clients?- so I decided for the next few months to show you the challenges and the lessons learned from personal experience.

- Appraisal value:

Last year I was selling a 4 bed house to some friends. We were under contract but the appraisal valued the house 10% less. This means that my friends wouldn't get the house because they didn't have the cash to make up for the difference. My clients knew very well the market and loved the house so we decided to change bank and order another appraisal which came this time above asking price ! They are now living in their dream home.

Lessons learned: Trust your market research and be confident in the choices we make together. Also use a mortgage broker since he will be able to turn around quicker and find solutions rather than an independent bank.

- Inspection period:

In general inspection periods are by default 15 days. This means a buyer has 15 days after getting into contract to inspect the condo/house and cancel if he wishes to without any reason (As-Is contract). A few years back I wanted to get my buyer into a foreclosed property. Several buyers were bidding, the bids were unknown and my client's budget was limited. I decided at my expense to send an inspector the same day even if we had not made the offer yet. He told us over the phone the minor issues and we put in the offer with "0" inspection days. Needless to say she got the unit because banks prefer to have a solid offer with no contingencies even if losing a few dollars.

Lesson learned: Price is not the only negotiable item in a home sales transaction. Use an experienced realtor (let's say me !) who has worked with foreclosures.

BEST MIAMI SPICE

Since last month I introduced the beginning of the Miami Spice, this month I decided to tell you my Top-3 participant restaurants that you definitely need to try.

You have 1 more month to enjoy the Miami Spice event so hurry !

1. Komodo: For the appetizer and Entree, Komodo restaurant offers 5 different options. Without thinking it twice I went (and would go again) for the Duck Lettuce Wraps and appetizer and skirt steak duck lettuce and the Wagyu Skirt Steak with crispy onion. For dessert, I would recommend the Dulce de Leche Creme.

2. Novikov: One of the biggest competitors in the Miami Spice of this year is Novikov. Out of the fixed menu options, my personal favorite choice starts with Truffle Hamachi Carpaccio as the appetizer, the Steamed Branzino, Soy and Ginger as the entree and finishing with an exquisite Guava cheesecake as dessert.

3. Byblos: Two included appetizers, one entree, and one dessert was a hard selection at Byblos when I went. I picked the Ahi Tuna and the Hamachi as appetizers, the Ras El Hanout Black Cod as Entree and the Hazelnut Chocolate Mouse as dessert. Wouldn't change my choice in a lifetime.

Let's hope we can enjoy Kosushi for the Miami spice this upcoming month... Let's cross fingers it opens soon enough.

DEAL OF THE MONTH: TRUMP HOLLYWOOD #2502

- $1,890,000

- Oceanfront

- 3,062 sqft

- Wrap-around balcony

- 3 beds / 3.5 baths

- Maintenance fee: $2,066 /month

- Price: $617/sqft

Condo Buying Tips

Is it the right time to refinance?