IS THE REAL ESTATE MARKET THAWING?

The US housing market, frozen by a combination of factors including high mortgage rates, low inventory, and soaring home prices, may take years to fully thaw but it’s on its way. Despite the prospect of easing mortgage rates, the "lock-in" effect created after the pandemic housing boom, where homeowners are reluctant to move due to higher mortgage rates, is likely to persist. Consequently, both homebuying and selling activities are expected to remain subdued. Unfortunately for us realtors, the volume of sales might not be very high this year but promising.

Even with forecasts suggesting a modest increase in house prices, the consensus remains pessimistic about any significant surge in homebuying activity. Capital Economics projects a 5% rise in house prices, surpassing the consensus estimate of 3%. However, tight competition for homes and historically low affordability will continue to dampen market activity.

Bottom line if you see a house or a condo you like just jump on it because chances are slim you'll find another one or a reduced price. The good news is that February saw a huge surge in home sales nationwide (9.5% increase vs January ) even if prices are still higher than ever. Additional homes on the market seemed to be driving sales up (inventory was up 6%) Are buyers finally returning to the market and able to find their dream house?

SHOULD I BUY A HOUSE NOW OR WAIT?

Considering whether to buy a house now or later in 2024? Well, let me break it down for you

Last December, the Federal Reserve hinted at potential interest rate cuts throughout 2024. Initially, experts were hopeful for early rate drops as they anticipated a decrease in inflation. However, with January seeing a rise of 3.1% in inflation, many economists now predict any rate cuts to happen later in 2024. So what should you do if you are house hunting?

If the Fed goes ahead with these rate cuts, it could mean better financing options for homebuyers and possibly more homes entering a market that's been craving increased inventory.

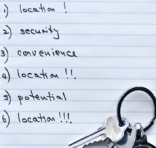

Nevertheless, here's why buying a house now could be a good idea:

On the flip side, here's why waiting until later in 2024 might appeal to you:

You could benefit from even lower rates and a wider selection of homes to choose from. However, keep in mind that home prices might continue to rise, and trying to perfectly time the market is always a bit of a gamble. But in Miami prices should decrease as the slow season approaches.

Bottom line, I think that if you're looking for your dream home, it might be wise to act sooner rather than later since competition with other buyers might be fierce if you wait. But if you're in no rush or eyeing an investment property, holding off could be worth considering. Happy house hunting!

HELOC OR HOME EQUITY LOAN FOR A SECOND HOME?

Considering whether to use a HELOC or a home equity loan to purchase a second home? Am I speaking chinese to you?

These 2 loans are on your first residence for you to avoid taking a loan on the second house and own that one free and clear. But which loan is better suited for buying that second home? Let's break it down:

HELOC (Home equity line of Credit) highlights:

HELOC considerations:

Home equity loan perks:

Home equity loan considerations: